According to data released by ANFIA (Associazione Nazionale Filiera Industria Automobilistica), in the first four-month period of 2024 car registrations in our country grew by 6.1 per cent. Here we analyse not only the numbers but also consumer trends towards different types of fuel to get an idea of the future car scenario. An outlook at the European car market is also provided.

According to the latest ANFIA report (April 2024) on the car market scenario, in April registrations increased by 7.5 compared to April 2023.

In the first four months of 2024 the registered a growth of 6.1% respect to January-April 2023.

Analyzing registrations by fuel type (at the time of the publication of this article, data is still provisional) in the first four-month period, registrations of petrol cars increased by 18.6% (31.1% share), while diesel cars dropped by 18.3% (14.9% market share in the period). Alternatively fuel cars in the four-month period grew by 8.4 % reaching a 54 % market share. Among them, electrified cars grew by 8% in the overall period.

Going into more detail, non-rechargeable hybrids grow by 14.9%, with a share of 38.5%, while registrations of rechargeable cars (BEVs and PHEVs) in the four-month period drop by 21.9% with a market share of 6% (down 2.2 percentage points compared to the same period in 2023).

In the end, gas-powered cars grew by 28.4% and LPG of 10.4%; together, in the four months period, the two fuels represent about the 9.5 % of the market (of which only the 0.2% is CNG.

“In April 2024, the Italian car market is back in the positive after the March slowdown (-3.7%), up 7.5%, thanks to two more working days respect to April 2023 (20 days against 18) – says Roberto Vavassori, ANFIA President – but a large gap remains to be bridged compared to pre-pandemic volumes (-22.4% respect to April 2019).

Still high interest rates and economic uncertainty for households in general are not helping to achieve a level of registrations that will enable them to meet European environmental goals.

In addition, the serious delay in implementing the rule on new incentives adds to the factors that draw a less than positive picture for the sector.

The offer of local low- and zero-emission models increases buyers’ choice, but this seems to be insufficient to bring the market back to levels necessary for an effective renewal of Italy’s circulating fleet, which is among the oldest and most polluting in Europe”.

A glance at the European car market

As far as the European car market is concerned, registrations for the first four months are up 6.5% compared to the same period last year.

According to data released by ACEA on May 22nd, car registrations in the entire European Union plus EFTA the United Kingdom1 totalled 1,080,913 units in April, 12% more than in April 2023.

In the first four months, new car registrations were 4,476,369 units, a positive change of 6.5% year-on-year. All five major markets (including the UK) recorded positive performances: double-digit growth in Spain (+23.1%), Germany (+19.8%) and France (+10.9%), followed by Italy (+7.7%) and the UK, with a more modest increase (+1%).

“The next five years – said Roberto Vavassori – coinciding with the term of office of the future European Parliament, will be a critical period for the automotive industry. The industry is facing significant challenges and opportunities amidst the ongoing green and digital transition. A strategic industrial policy plan for the future should prioritise production reconversion, investment in innovation, research and development, and employee training and retraining. This emphasis on strategic planning and foresight is crucial for the companies’ future success”.

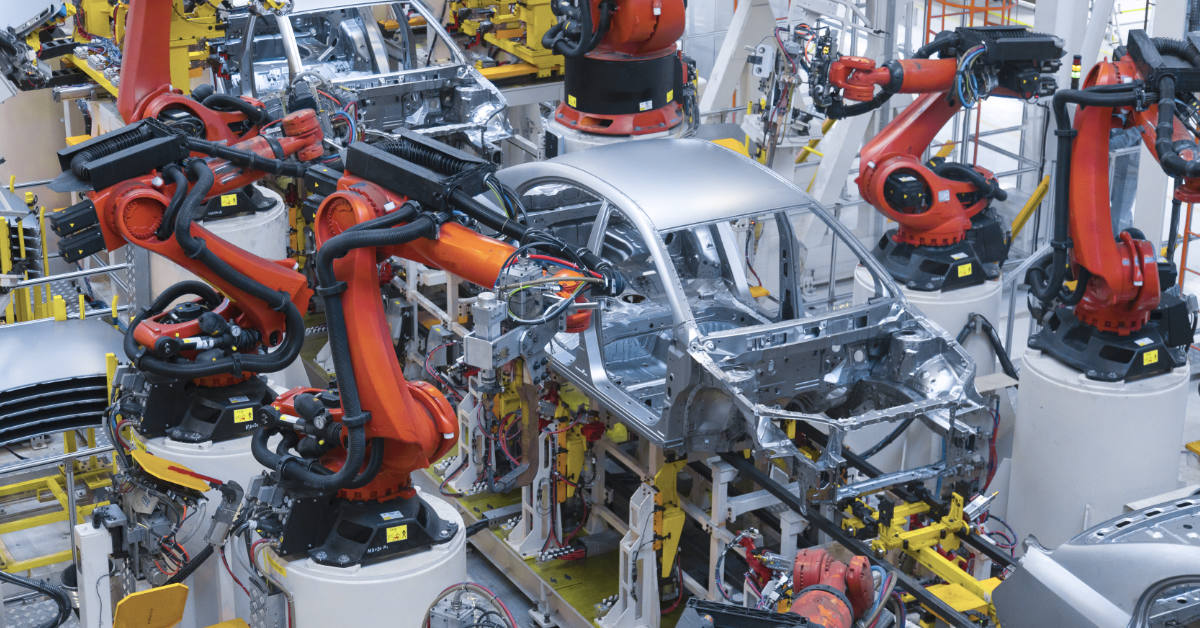

Digitalisation, Safe and Smart Mobility

The automotive supply chain is fully in line with Industry 4.0 and 5.0 in terms of digitisation, automation and sustainability of production processes, which companies are called upon to improve and make more efficient.

In the automotive sector, however, digitisation does not only affect production processes, but also products, with vehicles becoming increasingly connected and, eventually, driverless. This has direct implications for vehicle safety, for instance with respect to the issue of data access, and thus cybersecurity, and with respect to the evolution of ADAS systems.

Supporting the digitisation of companies and the development of autonomous and connected driving technologies is fully part of ANFIA’s mission.

The automotive sector requires new skills and expertise

An interesting contribution on the sector is also offered by the report Automotive Global HR Trends – realised by Gi Group Holding in collaboration with the Connected Car & Mobility Observatory of the Politecnico di Milano and ANFIA. Based on a survey sample involving 11 countries and more than 6,500 decision makers, the report offers an overview of how the automotive sector, driven by emerging technologies, changes in consumer preferences and new logistics challenges, is changing, the impacts on the HR function and the skills of those working in the sector, and the new paths that are driving it towards a future of inclusiveness and innovation.

One of the challenges that the automotive sector is currently facing concerns the demand for new skills and expertise, linked, above all, to electric and hydrogen technologies, the paradigm of mobility as a service, the digitalisation of production processes, and the connected and self-driving vehicle. Sustainable development objectives in the field of Environment, Social and Governance (ESG) are also gaining positions on the priority scale of companies, concretely affecting the market’s perception of the company and also touching on management capabilities.

Source: InMotion by Publitec